property tax las vegas nv

The figure you are left with is your capital gain on the property and based on your non-property income you will have to pay up to 30 in federal and state taxes on your capital. SOLD MAY 23 2022.

The Best Property Management Companies In Las Vegas Nevada Of 2022 Propertymanagement Com

Tax Rate 32782 per hundred dollars.

. Las Vegas NV currently has 4044 tax liens available as of November 5. Property Tax Rates for Nevada Local Governments Redbook NRS 3610445 also requires the Department to post the rates of taxes imposed by various taxing entities and the revenues. A composite rate will produce expected total tax receipts and also.

Payments can be made by calling our automated information system at 702 455-4323 and selecting option 1. Las Vegas NV 89155-1220. The median property tax in Clark County Nevada is 1841 per year for a home worth the median value of 257300.

Disabled Veterans Exemption which provides for veterans who have a permanent service-connected disability of at least 60. 500 S Grand Central Pkwy 1st Floor. Tax District 200.

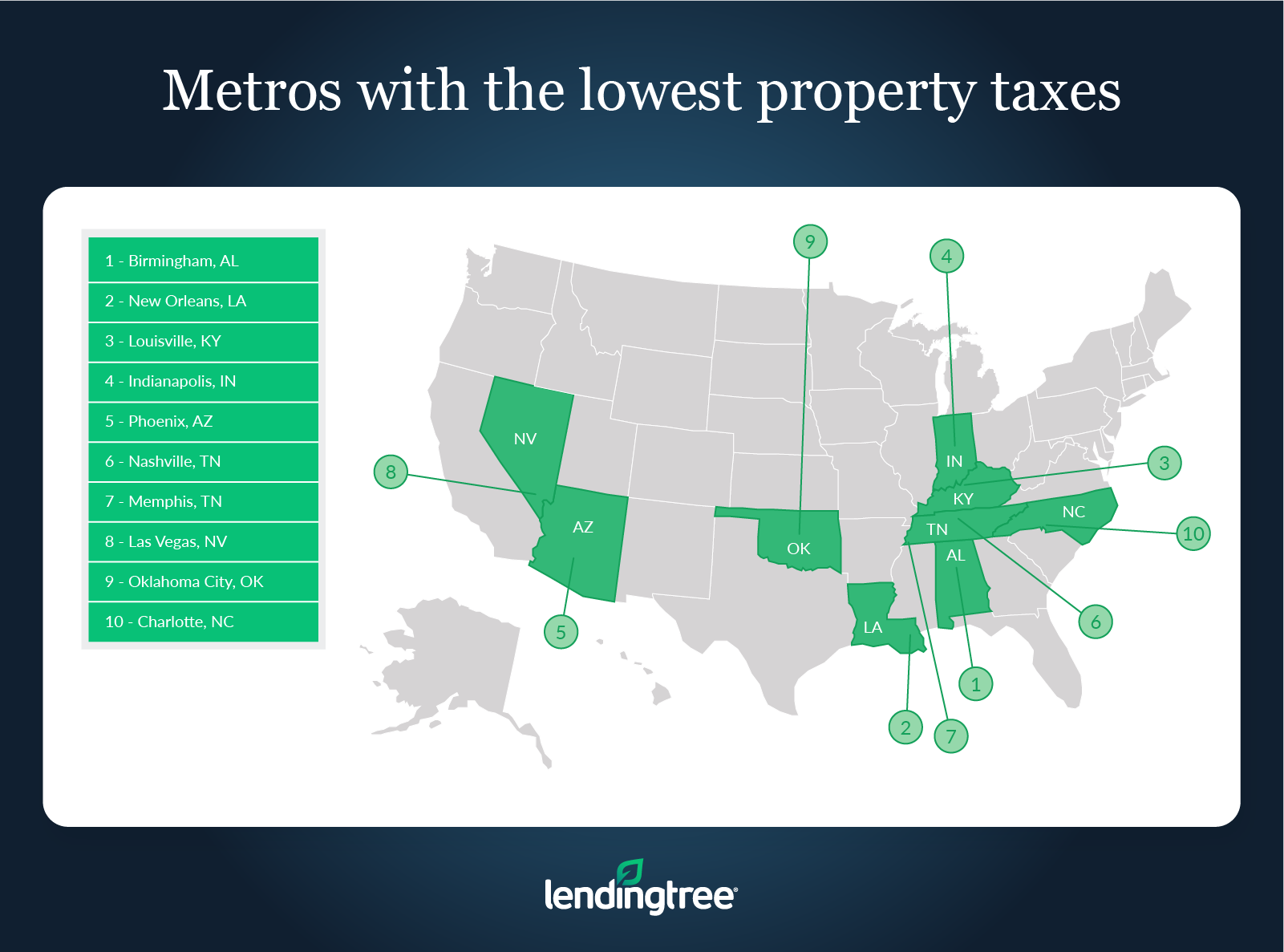

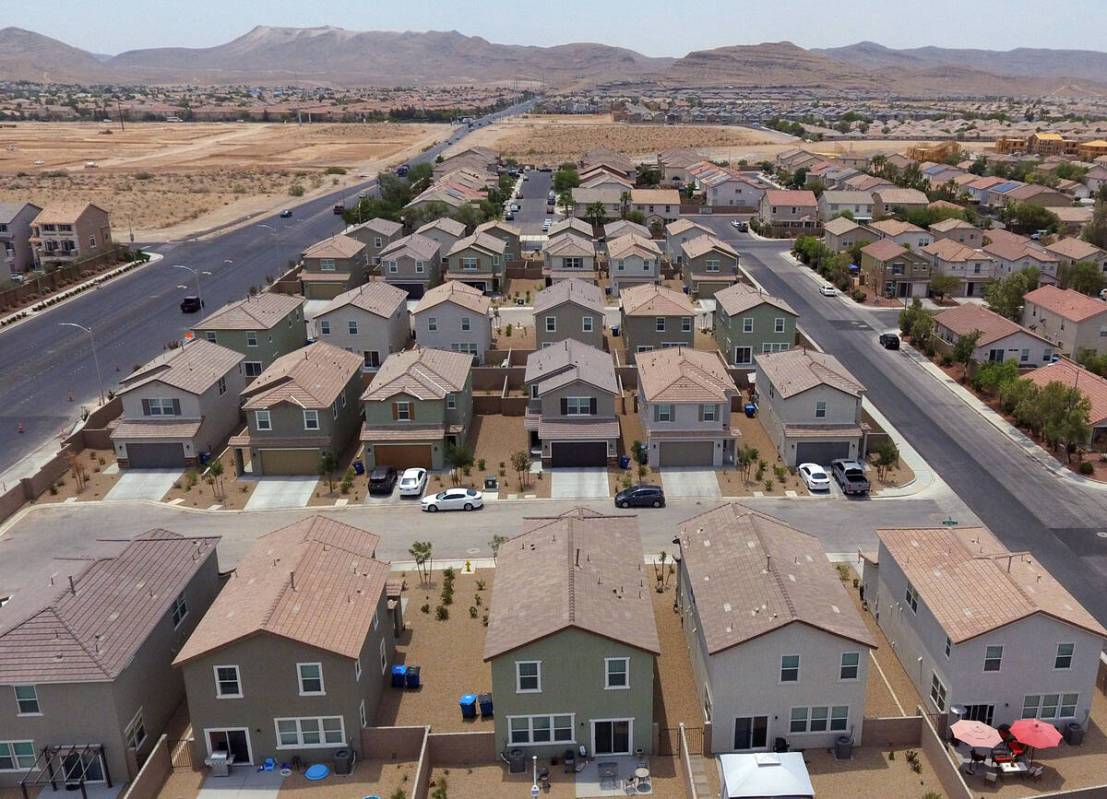

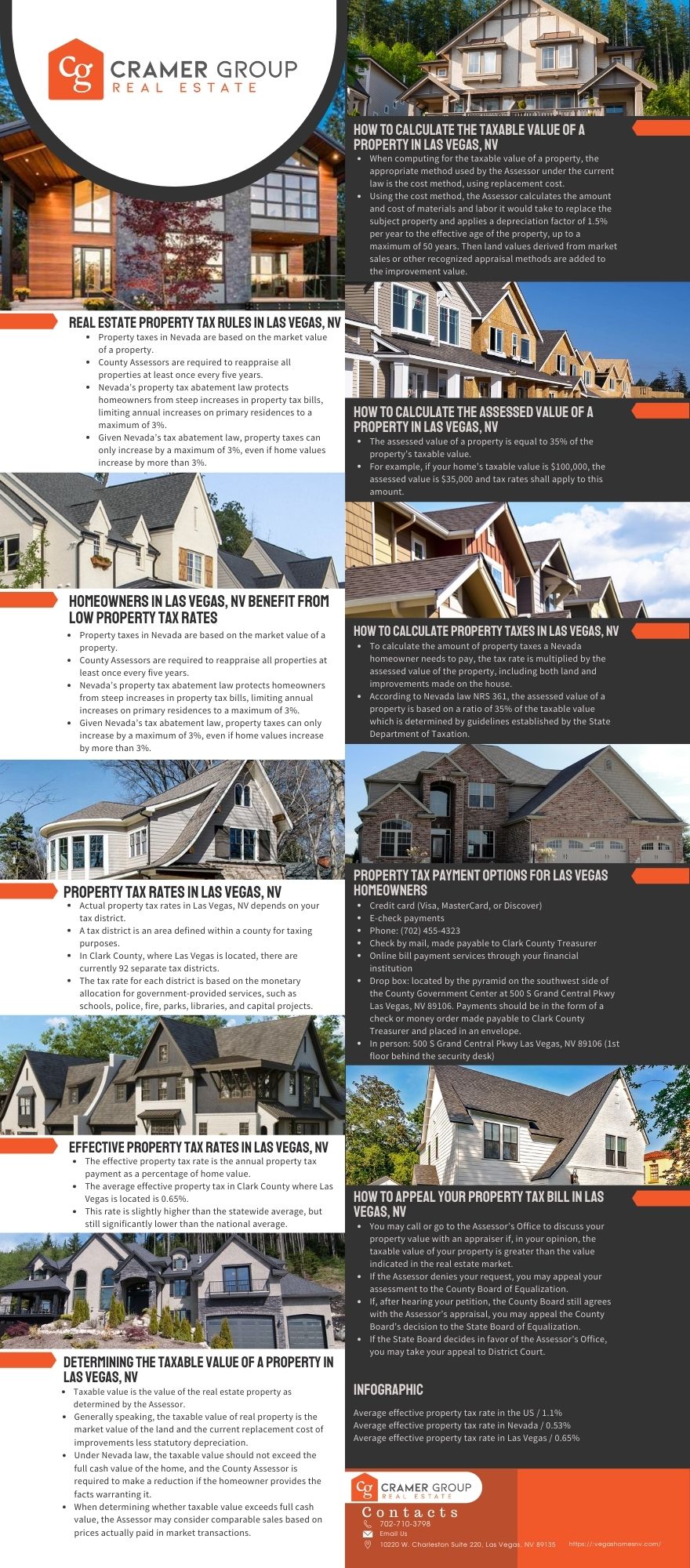

CALCULATING LAS VEGAS PROPERTY TAXES. 625000 Last Sold Price. However the property tax rates in Nevada are some of the lowest in the US.

500 S Grand Central Pkwy. Reno Department of Taxation sales tax rate las vegas nevada 4600 Kietzke Lane Building L Room 235 Reno. Property Tax Cap Video.

Office of the County Treasurer. Road Document Listing Inquiry. What is the Property Tax Rate for Las Vegas Nevada.

Nevada is ranked number twenty four out of the fifty. 200000 taxable value x 35. In Nevada the market value of.

With market values established Las Vegas along with other in-county public districts will calculate tax levies alone. The median property tax in Nevada is 084 of a propertys assesed fair market value as property tax per year. Information on roads and other right-of-way parcels may be obtained by one of the links under the Road Document Listing.

Clark County collects on average 072 of a propertys assessed fair. Tax amount varies by county. Public Property Records provide information on land homes and commercial.

Only one property may be selected in. Checks for real property tax. You can expect to see property taxes calculated at about 5 to 75 of the homes purchase price.

Property taxes in Nevada pay for local services such as roads schools and police. A Las Vegas Property Records Search locates real estate documents related to property in Las Vegas Nevada. All other properties are subject to the Other tax rate cap also known as the commercial property tax rate which can be up to 8.

The states average effective. The property may be redeemed by payment of taxes and accruing taxes penalties and cost together with interest on the taxes at the rate of 10 percent per annum from the original date. To calculate the tax on a new home that does not qualify for the tax abatement lets assume you have a Home in Las Vegas with a taxable value.

Smart homebuyers and savvy investors looking for rich money-making opportunities buy tax-delinquent properties in. Las Vegas NV 89106. Las Vegas NV.

Nearby homes similar to 9540 Grand Pass Ct have recently sold between 569K to 1450K at an average of 280 per square foot. Determine the assessed value by multiplying the taxable value by the assessment ratio. Click here to pay real property taxes.

The amount of exemption is dependent upon the degree. You must have either an 11-digit.

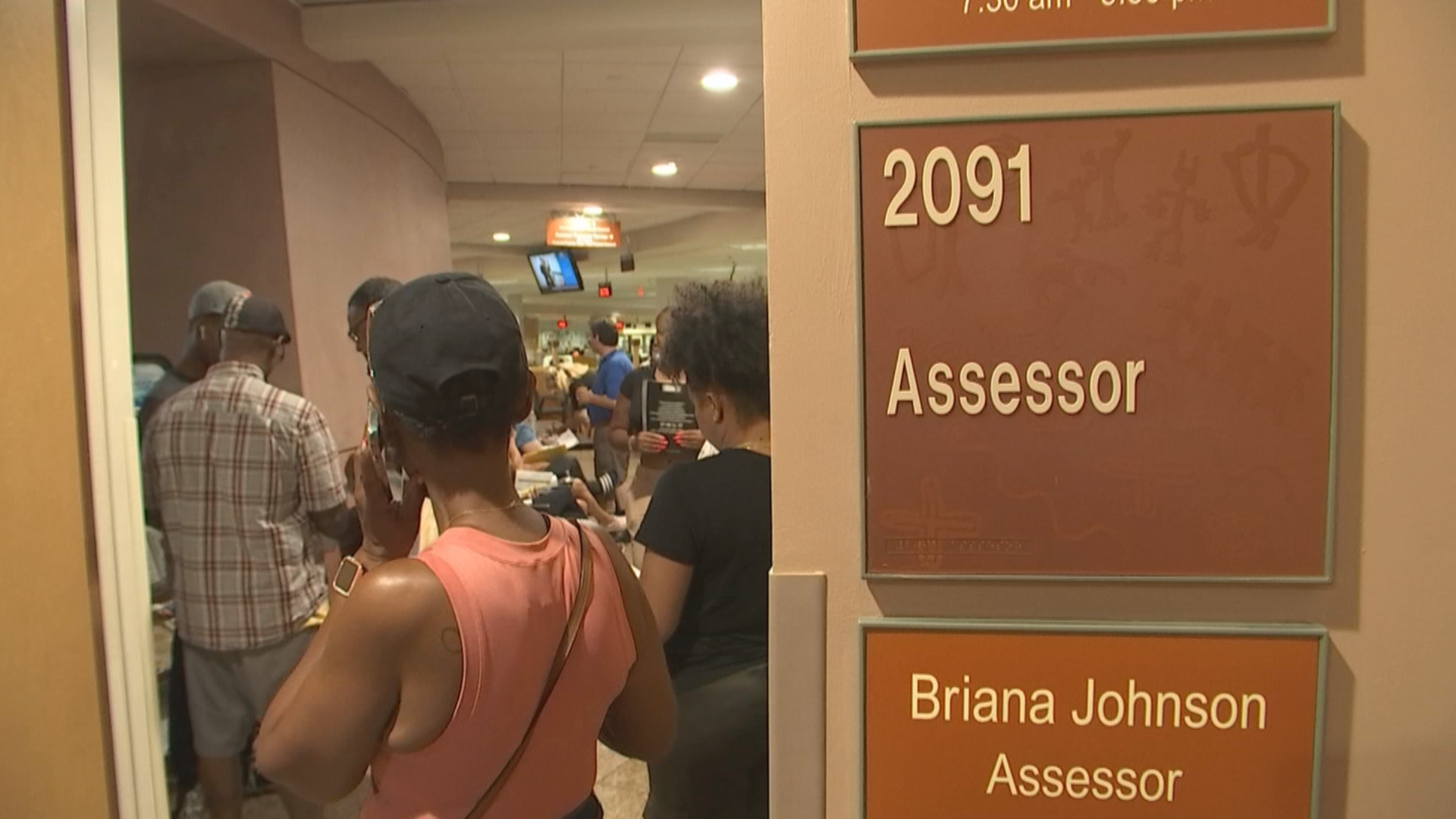

Clark County Mails Property Tax Bills After Correction Frenzy

Nevada Property Tax Calculator Smartasset

Calculating Las Vegas Property Taxes Las Vegas Real Estate Las Vegas Homes For Sale Las Vegas Real Estate

Be Sure To Lower Your Property Tax By Filing A Primary Residential Tax Cap Claim Ksnv

Letter Property Tax Bill About Maintaining Services For Nevadans Las Vegas Review Journal

/cloudfront-us-east-1.images.arcpublishing.com/gray/X3V2BLFPWFD7JBZ5EHJ2AQMNIA.jpg)

Clark County Clarifies Deadline For Homeowners To Update Info To Avoid Higher Property Tax Rate

7028 St Lucia St Las Vegas Nv 89131 Redfin

Nevada Ranked At 9 For Lowest Property Taxes Las Vegas Review Journal

1300 C St Las Vegas Nv 89106 Mls 2141710 Redfin

Nevada Tax Rates And Benefits Living In Nevada Saves Money

1409 S Eastern Ave Las Vegas Nv 89104 Loopnet

Nevada Vs California Taxes Explained Retirebetternow Com

Be Sure To Lower Your Property Tax By Filing A Primary Residential Tax Cap Claim Ksnv

Fill Out This Form Save Money On Property Taxes Boulder City Home Of Hoover Dam Lake Mead

Property Taxes In Las Vegas Nv The Cramer Group At Urban Nest Realty

Las Vegas Property Tax Frequently Asked Questions Rob Jensen Company

.png)